Renters Insurance in and around Baton Rouge

Baton Rouge renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

No matter what you're considering as you rent a home - number of bathrooms, furnishings, size, house or apartment - getting the right insurance can be valuable in the event of the unpredictable.

Baton Rouge renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Renters Insurance You Can Count On

The unexpected happens. Unfortunately, the valuables in your rented condo, such as a set of golf clubs, a couch and a tool set, aren't immune to abrupt water damage or burglary. Your good neighbor, agent Blake Jenevein, is passionate about helping you know your savings options and find the right insurance options to protect your personal posessions.

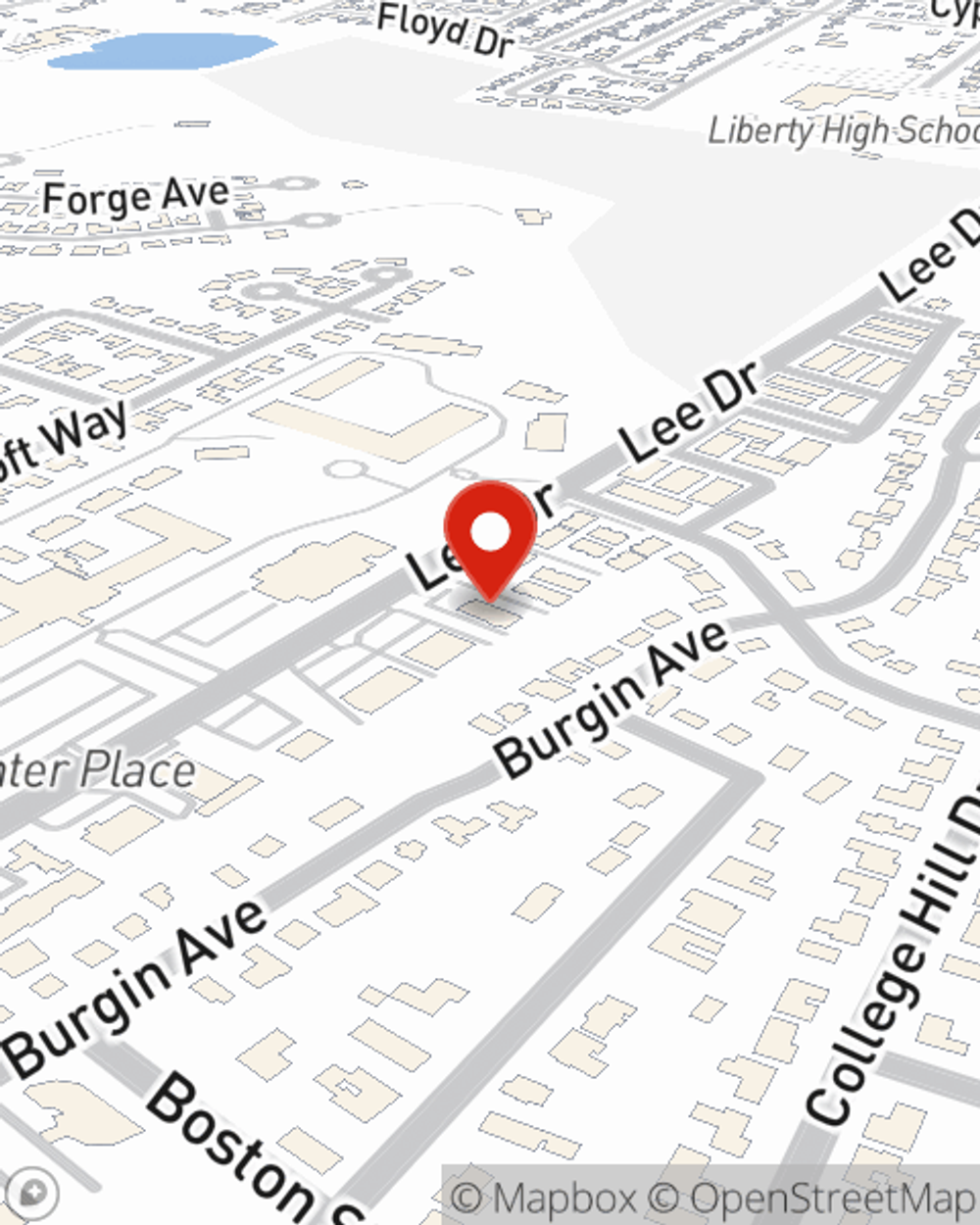

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Blake Jenevein for help understanding coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Blake at (225) 766-8721 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Blake Jenevein

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.